Financial deepening and the informal economy:

Evidence from local credit cycles in India

Authors: Myriam Marending and Gabriel Züllig

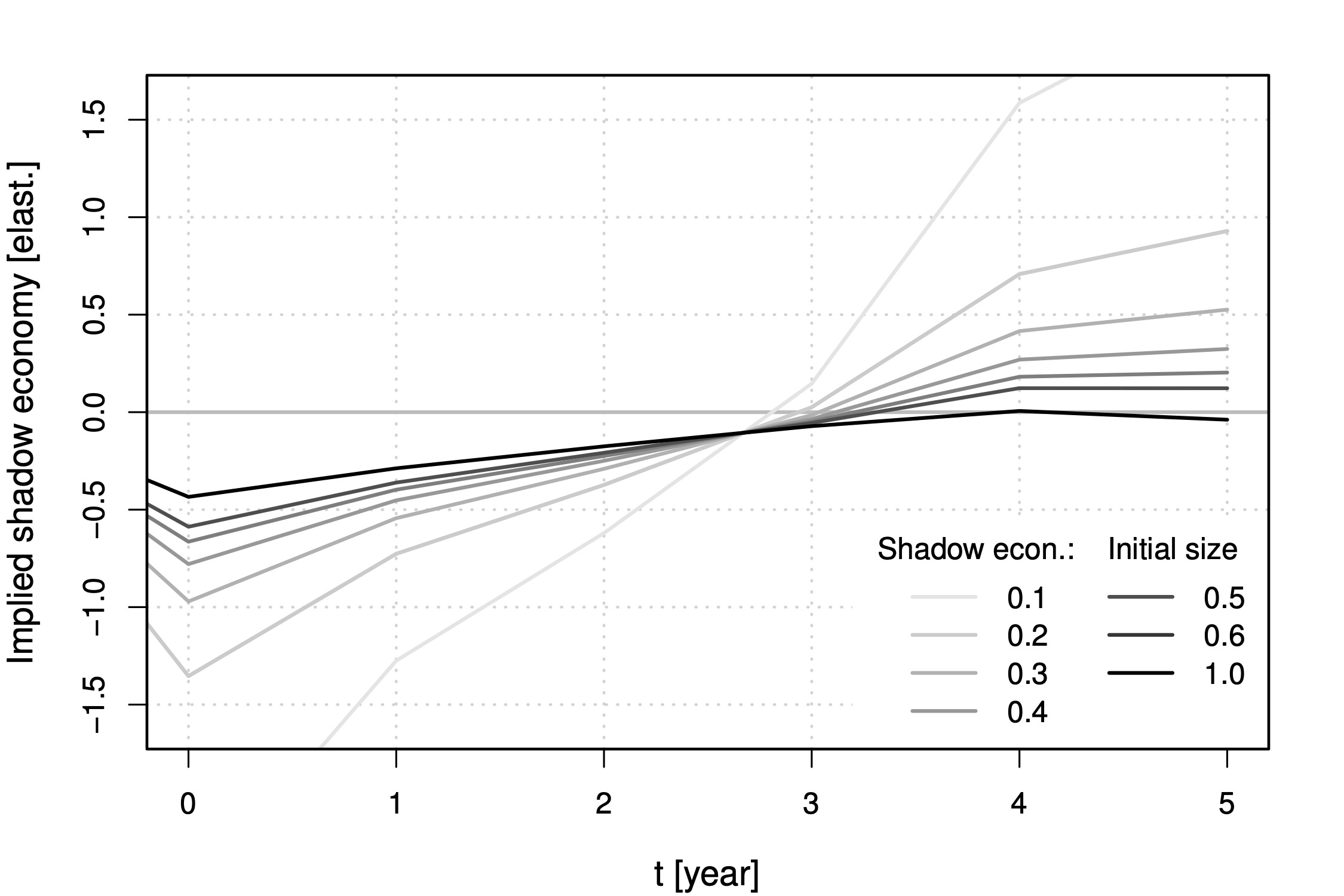

Abstract: We analyse the role of formal credit on the size and dynamics of the shadow econ- omy in India, an economy with a large informal sector and large cross-sectional and time heterogeneity in bank credit availability. We use district-level bank lending data from the Reserve Bank of India from 1998 to 2017 and measure light emissions observed from outer space at nighttime to proxy for economic activity. The identification strategy relies on the importance of gold as a collateral commodity for credit in India. We find that gold price fluctuations have a significantly expanding effect on credit supply. Credit supply expansions lead to growth of formal GDP (with a structural elasticity between 0.1 and 0.2). According to our estimates, resources are re-allocated from the informal to the formal sector. In the short run, the contraction of the informal sector is so strong that economic output as a whole tends to fall. The economy reaps the benefits of formalization after credit becomes more easily available only over the course of 3-5 years.

CREDIT SUPPLY SHOCKS AND THE SHADOW ECONOMY

This figure shows structual elasticities of the shadow economy with respect to credit supply expansion for different assumed initial sized of the shadow economy as share of total economic activity measured using nighttime luminosity. For a size of the initial shadow economy of 10 up to 40 percent, the initial contraction of the informal sector is large, namely between -0.3 to as much as -1.5 percent for every percent extension of credit. Therefore, we can conclude that the exogenous credit supply expansion leads to a reallocation of production from the informal to the formal sector. In order to obtain the more widely available bank credit, willing borrowers decide to formalize and devote resources elsewhere. The reallocation is strong enough to lead to a temporary contraction of total output. Sample: 1999-2017